On Thursday, the prices of the yellow metal gold slipped due to mixed signals on a trade deal between President Trump and President Xi Jinping ahead of the upcoming G-20 meeting. Gold traded lower falling 0.2% to trade at

$1,410.55 per ounce.

The U.S.- China Trade Deal & G20 Summit

Overnight, a report issued by the U.S. Treasury Steven Mnuchin states that the United States is around 90% on the way to reaching a trade deal with China and there is a most reliable way to achieve this. He was positive about the conference between U.S. President Donald Trump and Chinese counterpart Xi Jinping at the G20 meeting at Osaka Prefecture, Japan on Saturday.

Furthermore, U.S. Treasury Steven Mnuchin remarks arrived after a report that the United States would like to hold additional tariff on 300$ billion if Bejing carries back goodwill beacons on the meeting table. Nevertheless, President Trump singled that he will inflict another round of tariff on China if China fails to progress in trades talks this weekend.

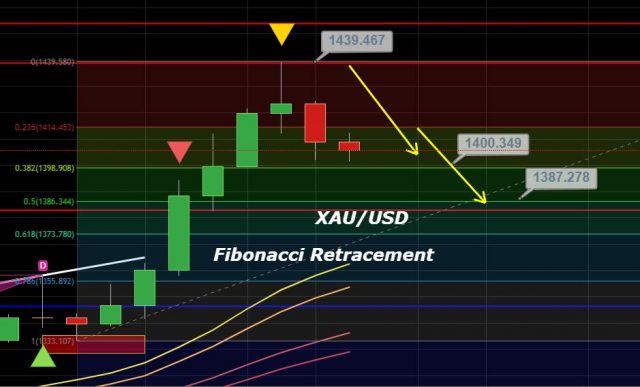

Gold - XAU/USD - Technical Analysis

Precious metal gold has entered the overbought zone, suggesting a potential for a bearish retracement. In fact, gold has made a bearish move this week, falling from 1,438 to $1,404.

On the daily chart, gold has completed 23.6% retracement, and it’s very likely to go ahead further lower towards 38.2% Fibonacci retracement level at $1,386.

In between both levels, gold may find support above the psychological level of $1,400.

R3: 1477.81

R2: 1450.34

R1: 1433.8

Key Trading Level: 1422.87

S1: 1406.33

S2: 1395.4

S3: 1367.93

Consider staying bearish below 1,400 and bullish above the same level to target 1,409 on the upper and 1,389 on the lower side. Good luck!