The yellow metal gold prices traded sideways on Friday amid uncertainties a highly anticipated meeting between the United States and China would reduce trade anxieties, leading bullion to its best month in three years.

Recalling our previous update, the market was anxiously waiting for the G20 meeting as it was the U.S. - China trade dispute which was triggering safe haven appeal in gold. The leaders of the Group of 20 nations gather on Friday and Saturday in Osaka, Japan, with a meeting between Trump and Xi Jinping due for Saturday.

In recent days, the trade strains pressured the stock exchange markets, fueling the demand of safe-haven bullion. The dollar index descended 0.1% after getting close to a one-week high in the prior session, making bullion more affordable for buyers in other currencies

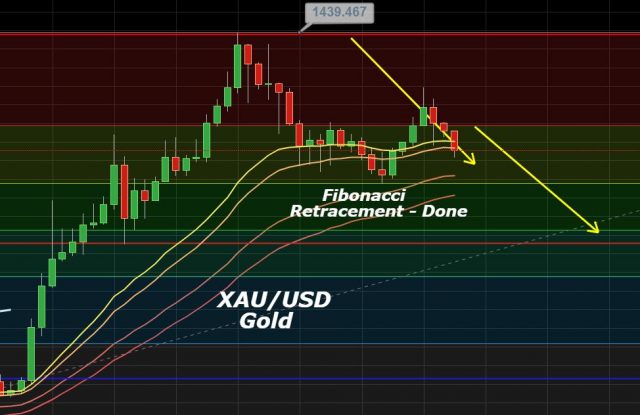

Technical Outlook - XAU/USD - Gold

With that being said, the technical side of the market hasn’t changed a lot as gold continues to follow the same technical levels. Taking a look at the daily timeframe, gold has completed 38.2% retracement at 1,398 before bouncing off.

For now, gold is following a narrow trading range of $1,422 - $1,398 and the breakout will determine the further trend in gold.

R3: 1477.81

R2: 1450.34

R1: 1433.8

Key Trading Level: 1422.87

S1: 1406.33

S2: 1395.4

S3: 1367.93

Consider staying bearish below 1,400 and bullish above the same level to target 1,419 on the upper and 1,389 on the lower side. Good luck!