Equidistant Channel is a trading tool which is widely used by the price action traders. Equidistant Channel is formed by two trend lines maintaining an equal distance between them. There are three types of Equidistant Channels that are used in the financial markets.

- Ascending Equidistant Channel

- Descending Equidistant Channel

- Horizontal Equidistant Channel

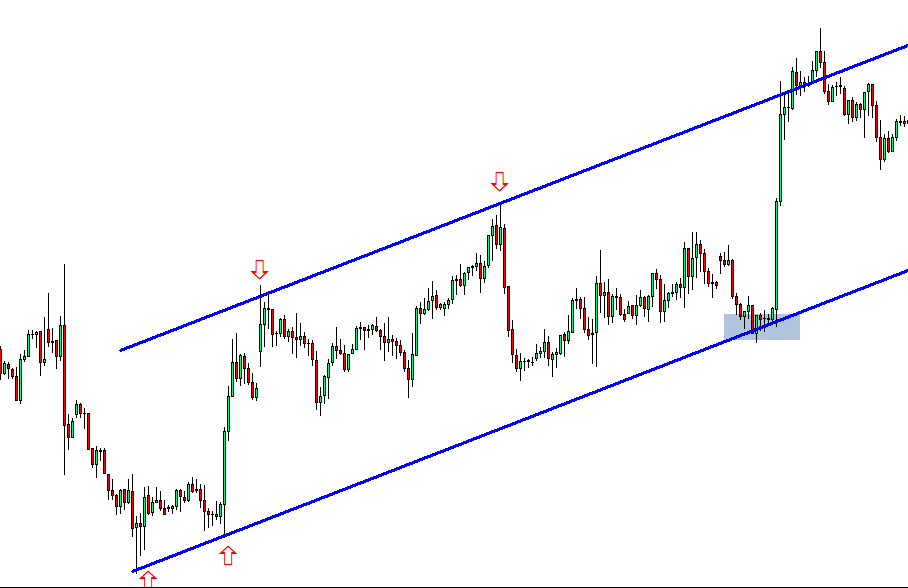

Ascending Equidistant Channel

This channel is drawn when the price is up trending. Entry should be taken when the price produces the signal around the support level of the channel. However, some traders take an entry from the resistance level against the trend, which does not offer a good risk and reward ratio, and it is risky too.

An Ascending Equidistant Channel

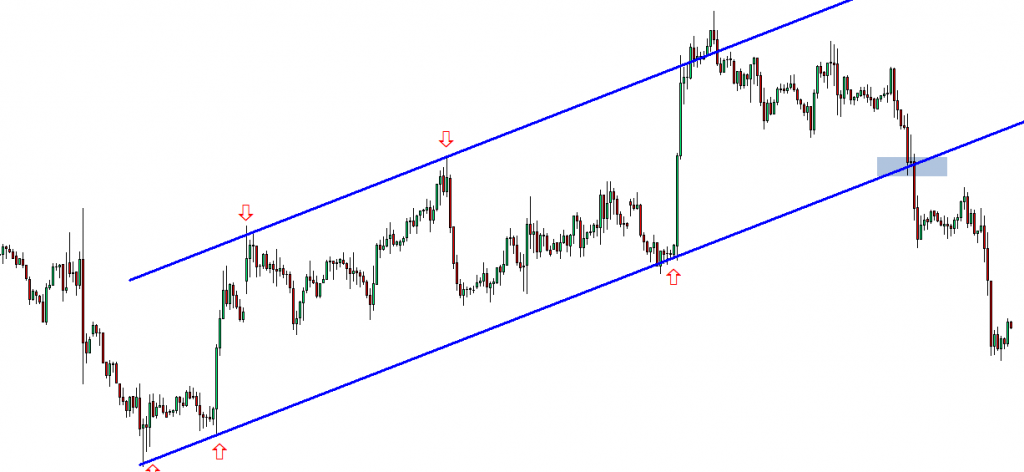

Descending Equidistant Channel

This channel is drawn when the price is down trending. To get the best risk and reward ratio, an entry should be taken when the signal is produced around the resistance level of the channel.

A Descending Equidistant Channel

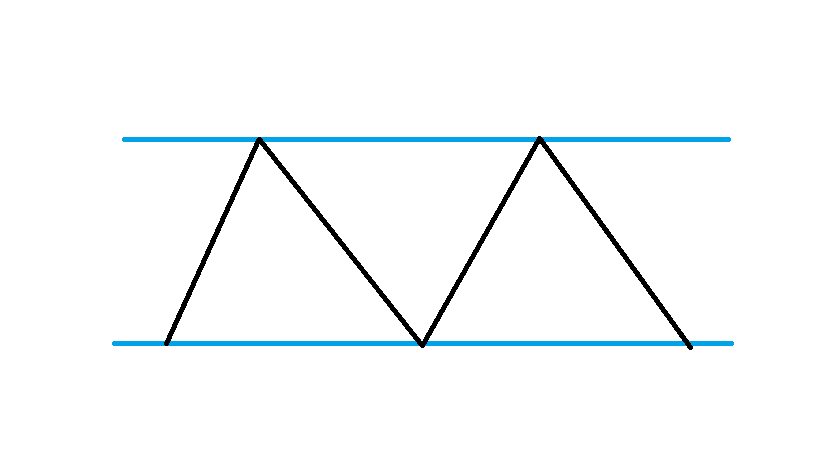

Horizontal Equidistant Channel

This is a tricky channel which is drawn when the price is not trending. Entry can be taken from the support level as well as the resistance level. Usually making money from a ranging market is a tough task. However, if the price obeys a Horizontal Equidistant Channel, money can be made with a good risk and reward ratio even when the price is within the range.

A Horizontal Equidistant Channel

Taking an Entry Based on an Equidistant Channel

First of all, we have to make sure that an Equidistant Channel is drawn accordingly. It takes 4 points to be joined to draw an Equidistant Channel. However, a channel can be drawn by using 3 points as well. On an Ascending Equidistant Channel, the resistance level may be confirmed if there is a bullish divergence. On the other hand, on a Descending Equidistant Channel, Support level may get confirmed by bearish divergence. Matter of fact is once an Equidistant Channel is drawn, we have to wait for the price to come around at our desired area and then produce the signal candle to offer us an entry.

Let us demonstrate it with an example here.

This is an Ascending Equidistant Channel. Resistance level had been confirmed by two down red arrows before the support level was. Then, the price came to the grey area and offered a long entry.

When to Take the Entry?

The chart produced a little Engulfing Candle before producing that huge Engulfing candle. A question might be raised here which one is the signal candle since both of them are Engulfing Candles. We had an Engulfing Candle here (the first one), but that did not make any breakout. However, the 2nd Engulfing Candle made a clear breakout. Can you spot where the breakout level is? Have a look at this

The price had a rejection twice at the red horizontal line. Then, the ticked candle made a breakout with strong command. This the signal candle. An entry should be taken right after that candle closes. The target is obvious and crystal clear.

How About More Entries

Yes, sometimes the price seems to get caught within an Equidistant Channel where more entries are possible. Once the target is hit here, we should wait for the price to come back at the support level and offer us more entries with a bullish reversal candle and a breakout of course. It does happen very often as well. Let us find out what happened here.

The marked area could have been held by the price. This might have eventually offered us another long entry. However, the support level could be held by the price. This means the party is over here.

Things to Remember

To be able to trade on an Equidistant Channel,

- We have to be able to mark support and resistance levels of the channel accordingly.

- Might have to do some adjustment by omitting noise/spikes

- On an Ascending Channel, an entry should be taken at/around the support level and on a Descending Channel, an entry should be taken at/around the resistance level

- A breakout has to take place, it could an anti-trend line breakout or a horizontal breakout at the nearest swing high or swing low.