Libra Unveiled

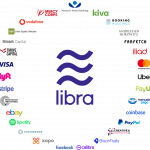

Yesterday morning Facebook’s ambitious adventure into the cryptocurrency world was uncovered: Libra was announced worldwide with the aim to be a global currency that potentially could be used by trillions on the planet. Currently, Facebook’s apps are used by more than 2,5 billion persons worldwide but the aim of the Libra cryptocurrency is even wider multiplying by 1000x its potential scope.

The Libra Association in charge of the management of the Libra Network said in the White Paper that this cryptocurrency would be a low volatility asset, as it will be fully funded by low volatility assets, such as Bank Notes and Government Funds. That will make it an attractive asset without the common volatility risks associated with the current crypto coins.

Along with this huge significance comes the size of the threat, this project seems to signify for the financial and political status quo. Yesterday things got really hot in Europe and The USA alike.

Immediate Reaction by French Finance Authority

French Finance Minister Bruno Le Maire got a bit shaken by this wave and stated on the E1 TV that Facebook’s Lira could not become a sovereign currency and that they were going to demand guarantees for consumers.

French Finance Minister Bruno Le Maire got a bit shaken by this wave and stated on the E1 TV that Facebook’s Lira could not become a sovereign currency and that they were going to demand guarantees for consumers.

That Facebook creates its own currency, a transaction instrument, why not?”

“The capacity to issue money, establish a reserve and be a last-resort moneylender: all this is our of question” - Bruno Le Maire

According to Le Maire, a currency is a sovereign question and must remain under the control of the States and not controlled by private hands.

Bruno also called for tighter regulation of the GAFAM companies.

This (Libra) is going to allow Facebook to accumulate again millions and millions of customer data. That reinforces my conviction that it is necessary a regulation of the Internet Giants to ensure they won’t be in a monopolistic position - That’s a key play of the 21st century

The BoE

According to yesterday’s Financial Times article Mark Carney, governor of the Bank of England said he’s keeping an “open mind” to the Libra Project, as he spoke at the Central Bankers conference in Portugal.

According to yesterday’s Financial Times article Mark Carney, governor of the Bank of England said he’s keeping an “open mind” to the Libra Project, as he spoke at the Central Bankers conference in Portugal.

Speaking about the new crypto coin said something quite logical

“it would instantly become systemic and will have to be subject to the highest standards of regulation” - Mark Carney

Under this calmed stance also came the reality of very close and tight surveillance of the project. Carney also stated that of one the BoE’s objectives was to guarantee the financial and monetary stability, so it would look at FB’s proposals “very closely and in a coordinated fashion at the level of the G7, the Bank of International Settlements, the Financial Stability Board and the IMF” (source ft.com)

US Lawmakers Call for a Halt on Facebooks Crypto

Back home, things aren’t easier.

Even before Libra’s official announcement, the US Senate Banking Committee wrote an open letter putting seven questions about regulatory, privacy, financial information and data records, sharing to other parties, and more.

Yesterday a Coindesk article revealed that Congresswoman Maxine Waters demanded Facebook to halt the Libra development until a hearing can be held.

Yesterday a Coindesk article revealed that Congresswoman Maxine Waters demanded Facebook to halt the Libra development until a hearing can be held.

“It is incumbent upon us as policymakers to understand Project Libra. We need to go beyond the rumors and speculations and provide a forum to assess this project and its potential unprecedented impact on the global financial system.”

Source Coindesk

Cnn reporter Brian Fung posted a tweet on the subject

Continuing with another one in which presents a written request by Seniormost Republican on the committee, Rep. Patrick McHenry

Meanwhile, the seniormost Republican on the committee, Rep. Patrick McHenry, sent a letter to Waters also asking for a hearing. pic.twitter.com/Rx2AX2pbKQ

— Brian Fung (@b_fung) June 18, 2019

Coindesk also mentions Sherrod Brown, Senate Banking Committee member, manifesting his strong opinions on Twitter:

Facebook is already too big and too powerful, and it has used that power to exploit users’ data without protecting their privacy. We cannot allow Facebook to run a risky new cryptocurrency out of a Swiss bank account without oversight. https://t.co/IjZOFNai3r

— Sherrod Brown (@SenSherrodBrown) June 18, 2019

China and Russia

China

According to an article by medium.com China “feels” an immediate threat by FB’s Libra. Although the report focuses on well-known internet and academic personalities in China, there is no official statement yet.

Libra will be a direct competitor to Q coin, a pre-bitcoin virtual currency utilised by Tencent’s users, an Internet-based technology enterprise with headquarters in Shenzen, China. According to the article, this non-crypto coin has reached 800 million users in March 2019.

Russia

A recent article by beincrypto.com Russia’s Duma is on the verge to adopt legislation on digital assets within two weeks.

“We discussed the bill and agreed on the final version of the text during a meeting last week. Fundamentally, everything is settled now. We are making the final revisions, and, hopefully, we’ll be ready to adopt it in the second reading within two weeks.” (source - beincrypto.com)

This article also mentions that Russia’s political authorities expressed their criticism about the Libra project yesterday. They stated that Russia would not be legalising Libra, although Russian citizens might be able to purchase it using foreign cryptocurrency exchanges.

Exciting times (and challenges) ahead for the Libra project and its leaders.