The Evening Star

The evening star is a candlestick pattern, which is a combination of two long candles and one short candle. The first candle in the pattern is a long bullish candle. The second candlestick is a short candlestick. In most cases, the second candlestick comes out as a Doji candle. However, if there is a price gap, the second candle might come out as a little bearish candle as well. This implies price consolidation and indecision. Since the first candle is a long bullish candle, so a Doji candle afterwards means that the created trend by the first long bullish candlestick is losing its momentum. The last candlestick is a long bearish candlestick closing below the first candlestick. This indicates the beginning of a new trend which is bearish, of course.

How Does It Look?

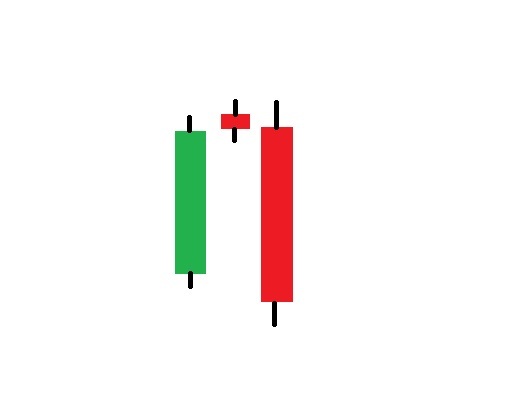

The evening star pattern would typically look like this

The first candle here is a long bullish candle, and the second candle is a little bearish candle. The second candle comes out as a bearish candle since there is a price gap. In most cases, the second candle comes out as a Doji candle, though. The third candle comes out as a long bearish candle, which does not only engulf the second candle but closes below the first candle. This is important that the last candle closes below the first candle to make a valid evening star candlestick pattern.

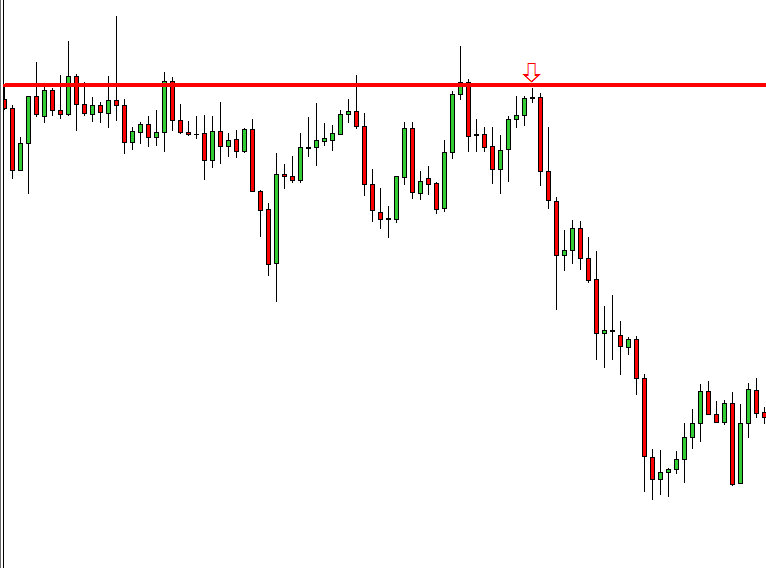

Let us now have a demonstration of how an evening star makes the price move.

The arrowed candle is the second candle here, which is a Doji candle. The first one was a bullish candle. Look at the third candle that closes much below than the first candle’s opening price. Afterwards, the price kept going down, and that was too with a very good pace.

The Message of an Evening Star

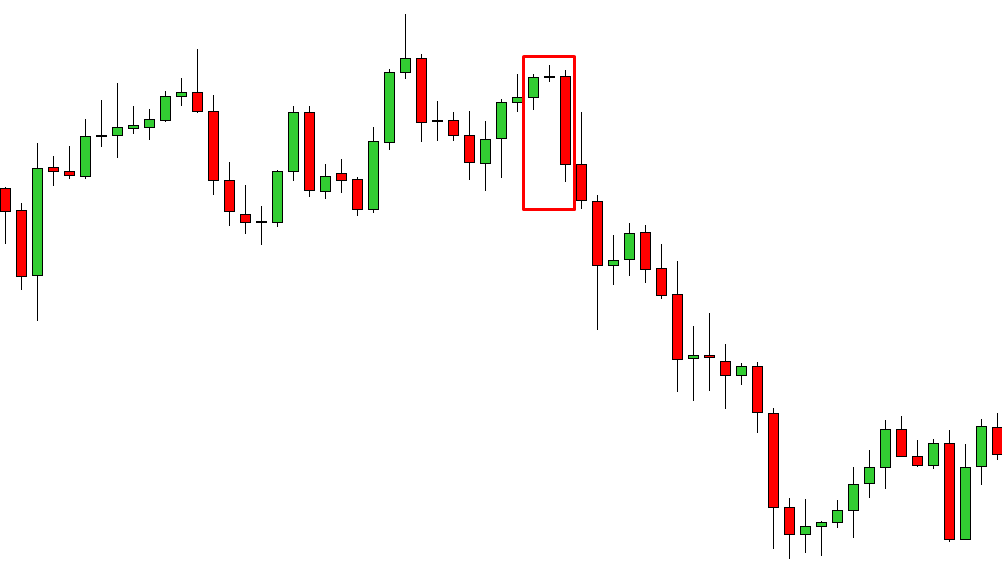

Let us zoom it in to have a clearer picture.

This gives us a better view. See the second candle having nobody at all, which is called Doji candle. We know that a Doji candle indicates indecision. In view that the first candle is a bullish candle, indecision here means that buyers are not confident enough to take the price towards the upside further. Then, the third candle comes out as a long bearish candle. This implies that the sellers have taken control over the buyers. This is the message that an evening star candlestick pattern confers to the traders.

How to Trade on an Evening Star

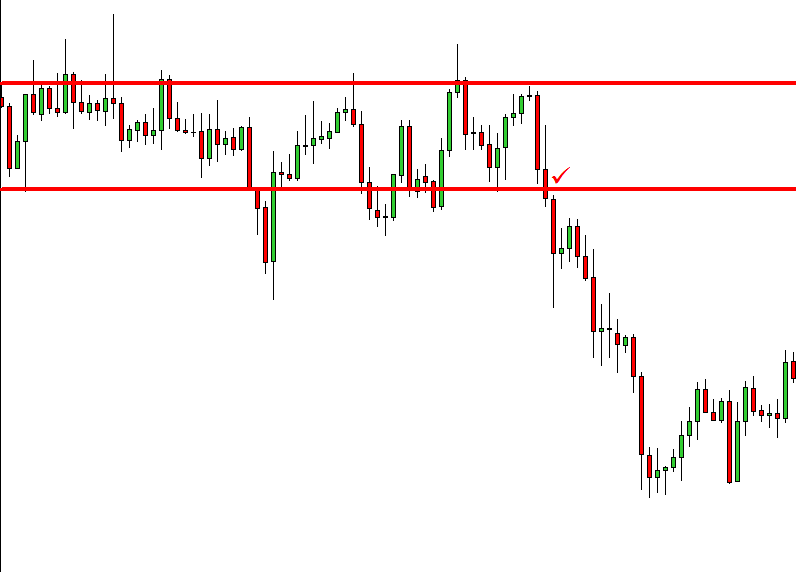

Three candles are needed to form an evening star. Many traders take a short entry right after the third candle’s closing. It is not a bad idea. However, to have a better winning percentage, we might as well wait for a breakout to take a short entry. It could be the previous swing low, a double top’s neckline or an anti-up trending trend line breakout. Can you guess what kind of breakout traders shall be waiting here for?

Have a look at the chart.

Look at the ticked candle. The candle makes a breakout here which is the neckline of a double top. Once the breakout took place here, the price headed towards the south with good momentum. In a nutshell, we take entries not right after an evening star, but after the breakout which is followed by an evening star.

Things to Remember

These are the key points about an evening star:

- An evening star is formed with the combination of three candles.

- The second candle has to be a Doji.

- The second candle must not be a little bearish candle without any price gap. Then it would be considered as an inside bar. However, it may come out as a little bearish candle if there is a price gap.

- The third candle has to close below the first candle’s opening price.